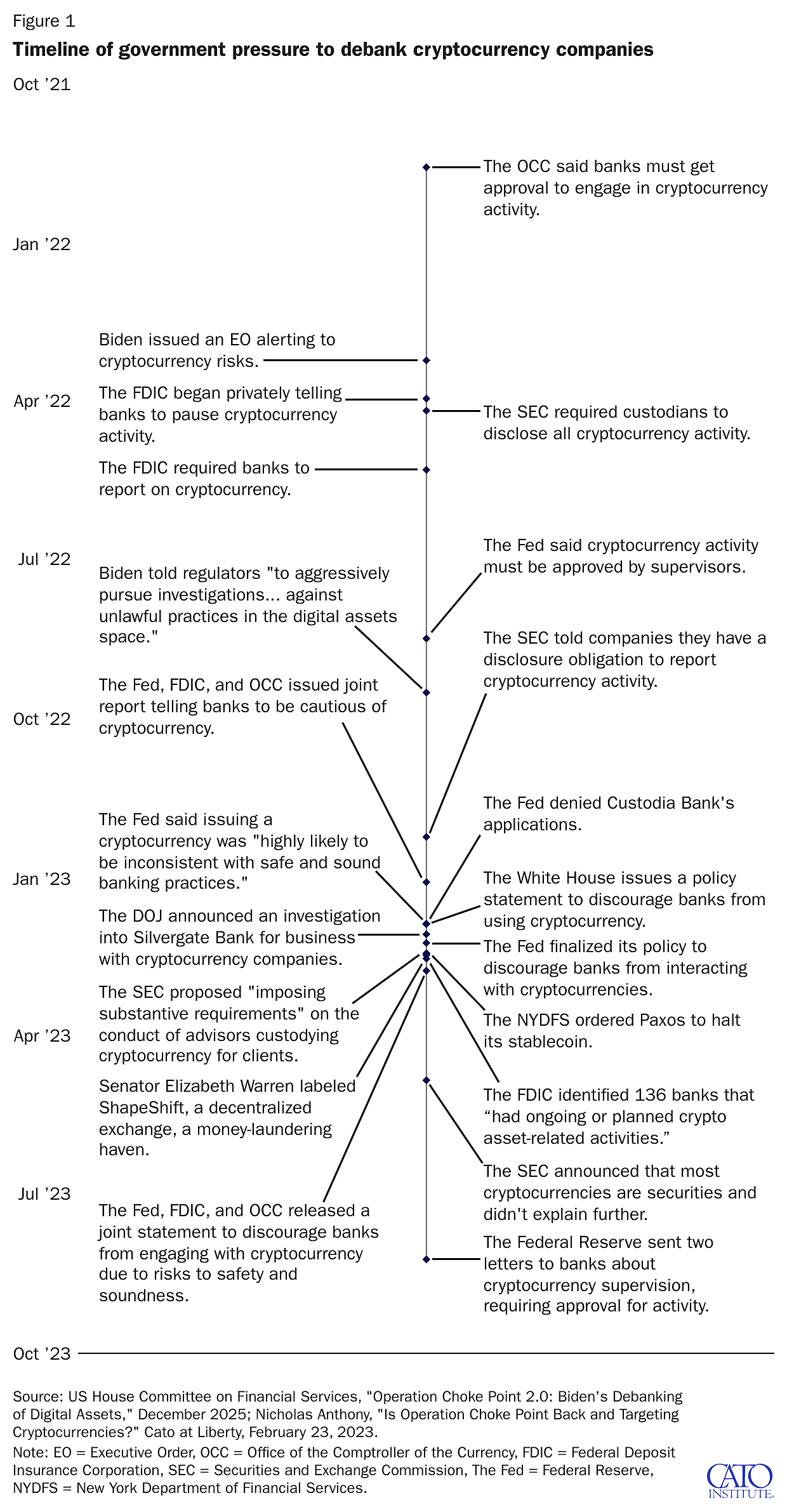

Closing out the year on a high note, Congress released a new report on the debanking of cryptocurrency companies and ways to prevent governmental debanking from taking place in the future. The report, “Operation Choke Point 2.0: Biden’s Debanking of Digital Assets,” presents a thorough timeline detailing how the Biden administration pushed banks to cut ties with businesses involved in cryptocurrency (Figure 1).

Back in 2023, Senator Bill Hagerty (R‑TN) said, “In the past few weeks, there’s been a coordinated chorus of regulators talking about severing crypto from our financial system. To me, this really feels reminiscent of Operation Choke Point.” Hagerty was right. The timeline shows that financial regulators across the board were trying to choke off cryptocurrency companies’ access to the financial system.

So, before we face Operation Choke Point 3.0, Congress needs to act, and this report is a great place to start.

Regulatory Discretion

Quoting Cato’s Norbert Michel, Congress warned that regulators have been given far too much discretion.

Vague laws and legal terms have long allowed federal regulators to choke certain businesses off from the US banking system. Indeed, regulators “have so much discretion that they have the authority to warn banks about dealing with certain types of customers for almost any reason they choose to justify.”

As Michel warned in the piece Congress cited, regulators were given the authority to govern the safety, soundness, and reputation of banks. And in doing so, Congress left it to the regulators to determine what exactly that means in practice.

Most people will like the idea of a bank being safe and sound. It’s even better if the bank holds a strong reputation. However, because regulators were given the discretion to define those terms as they see fit, those terms have become a hotspot for abuse. As Michel put it, “[T]hey have so much discretion that they have the authority to warn banks about dealing with certain types of customers for almost any reason they choose to justify.” And in practice, those warnings are effectively orders to close accounts.

To end this abuse, Congress needs to limit the discretion of regulators. As noted in the report’s recommendations, Senator Tim Scott’s (R‑SC) and Representative Andy Barr’s (R‑KY) Financial Integrity and Regulation Management (FIRM) Act would remove reputational risk regulation from the regulatory toolkit. Going further, Representative Scott Fitzgerald’s (R‑WI) Halting Uncertain Methods and Practices in Supervision (HUMPS) Act would reform the supervision process to narrow the scope of subjective ratings. Finally, Representative Dan Meuser’s (R‑PA) Stop Agency Fiat Enforcement (SAFE) of Guidance Act would require regulators to explicitly state that informal guidance is not legally enforceable. Efforts like these would help to limit the discretion of regulators and reduce uncertainty for banks.

“Suspiciously” Absent

While the report’s coverage of regulatory discretion was thorough, something was strangely absent from the recommendations: reforming the Bank Secrecy Act. What makes this absence strange is that the problems caused by the Bank Secrecy Act were mentioned at the beginning of the report. However, there was no mention of fixing those problems. Those reforms need to be on the table.

As noted in the report, a suspicious activity report (often abbreviated as SAR) is a red flag on a customer’s account. Yet, banks are prohibited by law from notifying customers about these red flags. If a customer accumulates too many of these flags (often just three), banks could face millions of dollars in fines.

[F]inancial institutions often do not provide any explanation—or much notice—to customers whose accounts are closed due to being labeled high-risk. In cases where a SAR is filed, banks are statutorily prohibited by the Bank Secrecy Act from disclosing the reason for account closure because it could indirectly notify the subject of a SAR that a SAR has been filed.

All the available evidence suggests that the majority of these reports are filed on innocent Americans. Yet, that innocence doesn’t matter. They are a red flag, nonetheless. Once a customer accumulates too many red flags, all the legal and regulatory incentives push banks to close the accounts. Making matters worse, customers are left in the dark because of the confidentiality that governs this system. Removing that confidentiality by repealing 31 U.S.C. Section 5318(g)(2), 12 U.S.C. Section 3420(b), and 18 U.S.C. Section 1510 would go a long way to establishing transparency. However, an even better option would be to take the Bank Secrecy Act head-on and reform the whole thing, reaffirming Americans’ rights.

Conclusion

Back in 2024, Representative Ritchie Torres (D‑NY) wrote that there is essentially “no real limitation on the ability of banking regulators to de-bank law-abiding citizens and businesses without due process of law.” He warned that governmental debanking “represents an insidious threat to civil liberties in America.” He’s right. Congress did well to document the repeated and systematic pressure from the government to debank cryptocurrency companies. Now the only question is whether reforms will happen before we see Operation Choke Point 3.0.